Montreal, Quebec — Beauce Gold Fields (Champs D’Or en Beauce) (TSXV: ¨BGF¨), (“BGF”): (“BGF” or the “Company”), referred to as “BGF” or the “Company,” is pleased to announce the results of the analysis of a preconcentrate sample, recovered from a bulk sample of fractured stockwork quartz vein from the Grondin antiform outcrop, on the Company’s Beauce gold property, located in the Beauce region of southern Quebec. The analysis returned 5.61 grams per ton of gold.

Patrick Levasseur, President and CEO of Beauce Gold Fields, stated: “Apart from the coarse gold grains, this demonstrates that non-visible gold mineralization may play an important role in the anticline (Saddle Reef type) structures. This structure holds significant promise for further lode gold discoveries.”

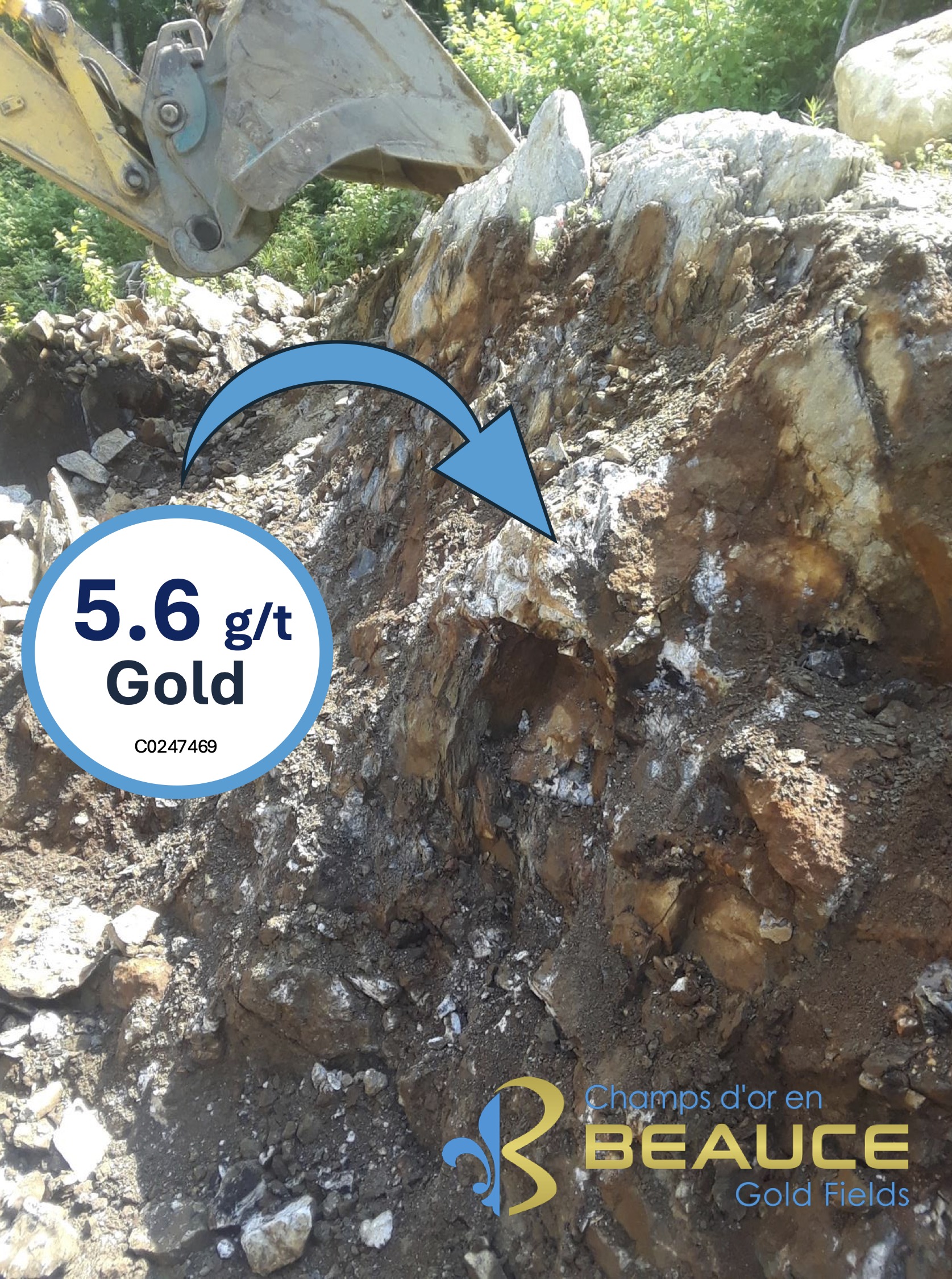

Image: stockwork vein of the Grondin outcrop, grade of sample C0247469

A 500-gram sample was randomly taken from one of the 20-litre buckets of preconcentrates. The preconcentrates were derived from loose fragments smaller than 10 cm, recovered using a mobile placer plant equipped with a trommel and sluice box. The placer plant processed a 30-ton bulk sample of heavily fractured stockwork featuring a milky white quartz vein several meters wide, interspersed with pockets of sulfide-rich material along shear planes of blocks of lapilli tuffs (BGF press release 2023-08-22) taken from the Grondin antiform outcrop.

The preconcentrates sent for analysis contained no visible gold grains. However, over 18 visible and sharply angular grains of gold from a final concentrate were previously extracted from the preconcentrates (BGF press release 2024-03-20). SEM analysis on several of these gold grains indicated that they contained an average of 85.05% gold (Au) and 14.74% silver (Ag), with the fineness of the gold grains (calculated as 1000 ⨉ Au / (Au + Ag)) ranging between 820 and 870 (BGF press release 2024-06-13).

The Grondin outcrop is located above drill hole GR 23-01, which the company drilled in 2023 (BGF press releases, November 1, 2023, and January 18, 2024). The drill hole crossed the entire length of the mineralized zone over 36 meters, intersecting three gold zones between 11 and 24 meters. All areas are associated with stockworks that contain varying levels of sulfides. The mineralized zones are strongly affected by significant deformation, led to significant core loss, especially towards the end of the drilling process. One of the intersected zones showed a notable grade of 5.4 g/t Au over 2.2 meters.

Test Certificate YVO2411180

|

Sample ID |

Pre Wt Kg |

CPA Mass Ana. WT g |

Au PPM |

|

C0247469 |

0.49 |

391.8 |

5.613 |

The outcrop is within the Grondin gold zone, a mineralized structure that follows the crest of an anticline fold (Saddle Reef type) and extends along strike for eight kilometers. Cumulative exploration data suggest that Saddle Reef-type formations are the likely bedrock sources of the company’s historical placer gold deposits.

QA/QC procedures for the reported preconcentrate sample include Certified Reference Materials from MSALABS of Val-d’Or, Quebec, Test Certificate YVO2411180. Standards and blanks were inserted into the sequence of samples on-site as part of quality assurance and quality control. MSALABS is an ISO-17025 accredited laboratory for the photon assay method.

Jean Bernard, BSc, Geo, a qualified independent person as defined by National Instrument 43-101, has reviewed and approved the technical information presented in this release.

Non-brokered private placement

The company wants to clarify that the following provisions replace the provisions relating to this private placement contained in the press release issued for the same private placement on November 7, 2024. The prices of the Units are set pursuant to the closing price of the Company’s shares on November 13, 2024

The Company will proceed with a non-brokered private placement of 5,000,000 Flow-Through units at $0.04 per unit for gross proceeds of $200,000 and 5,000,000 Hard Dollar units at $0.03 per unit for gross proceeds of $150,000.

Each Flow-through unit will be comprised of one (1) Flow-through common share and of one (1) common share purchase warrant of the company. Each warrant will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of $0.08 for a period of 24 months from the date of closing of the placement and each Hard Dollar unit will be comprised of one common share and one common share purchase warrant of the company which will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of $0.05 for a period of 36 months from the date of closing of the placement.

The offering is conditional upon the receipt of all necessary regulatory approvals, including the approval of the exchange. The proceeds of the offering will specifically be used: (i) to finance exploration and (ii) for general corporate purposes.

The offering will be offered to accredited investors in accordance with applicable securities laws. In connection with the offering, the company may pay finders’ fees, as permitted by the policies of the exchange. Each share issued pursuant to the placement will have a mandatory four-month-and-one-day hold period from the date of closing of the placement. The company anticipates that insiders may subscribe for units and their participation could exceed 25 per cent of the offering.

No more than 10% of the proceeds of the placement can be used for Investor Relations Activities. No amount of the proceeds of the placement is for payments to Non-Arm’s length parties of the company nor for payments to persons conducting Investor Relations Activities.

Beauce Gold Fields is a gold exploration company focused on placer to hard rock exploration in the Beauce region of Southern Quebec.