Montreal, Quebec — Beauce Gold Fields (Champs D’Or en Beauce) (TSXV: ¨BGF¨), (“BGF”): (“BGF” or the “Company”), referred to as “BGF” or the “Company,” is pleased to announce that geochemical soil sampling results have revealed five anomalies, aligning with previously identified IP anomalies along the mineralized zones of the antiform Saddle Reef structures on the Beauce Gold property located in Beauceville, Quebec. The integration of soil geochemistry and geophysical data has highlighted areas as high-priority drill targets.

Patrick Levasseur, President and CEO of Beauce Gold Fields, stated: “These anomalies, indicating strong potential for significant gold mineralization, justify a focused drilling and bulk sampling program to further explore the antiform (Saddle Reef-type) structures identified as the likely source of the historical placer deposits.”

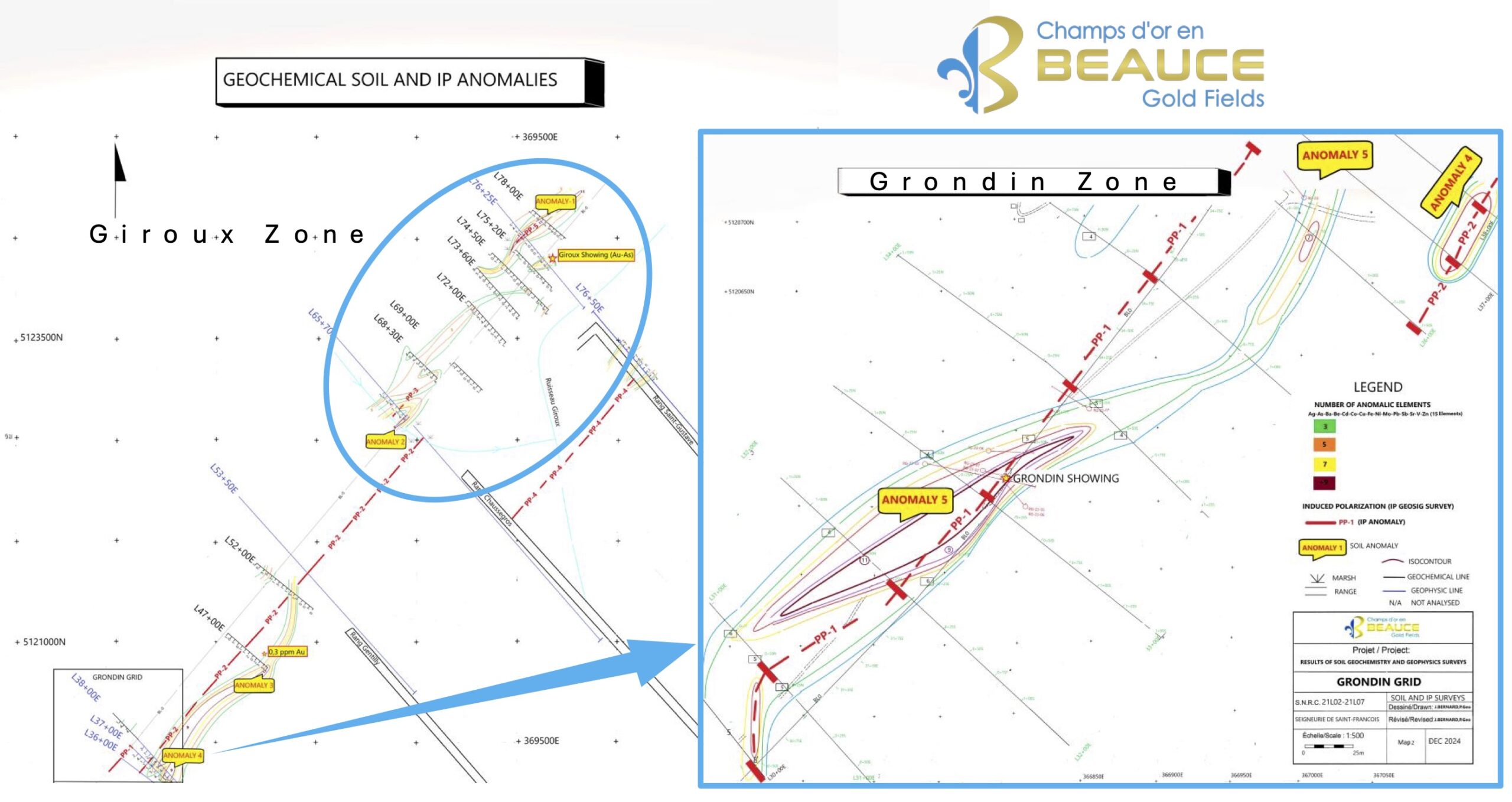

Image: Geochemical Soil and IP Anomalies

Soil Sample Analysis Overview

Recent soil sample results from the Beauce Gold Fields property have identified significant geochemical anomalies, correlating with previously defined mineralized zones and geophysical surveys.

- Key Anomalous Elements: The dominant pathfinder elements are Silver (Ag), Arsenic (As), Barium (Ba), and Antimony (Sb). Barium’s frequent association with anomalous gold zones underscores its value as a geochemical indicator. Additional elements of interest include Zinc (Zn), Copper (Cu), Lead (Pb), and Sulfur (S).

- Giroux Zone Anomalies (One and Two): Located at the headwaters of Giroux Brook—a tributary flowing into the Gilbert River, the epicenter of 19th-century industrial-scale placer gold mining—these anomalies overlap with IP signatures of the antiform structure. Anomaly One returned 11 anomalous elements, while Anomaly Two returned 9. Both align with IP anomalies PP-3 (L65) and PP-4 PP-5 (L76) and with the Giroux outcrop (refer to BGF press release dated 11-07-2024).

- Anomaly Three: Exhibiting very strong geochemical signatures in several metals (Ag, As, Ba, Cu, Sb), this anomaly aligns with IP anomaly PP-2, located south of the soil anomaly. A historical grab sample in the area reported 0.3 ppm Au (GM70597). This site corresponds to a fractured fold axis (anticline) featuring quartz and sulfide showings.

- Anomaly Four: A large geochemical anomaly at L38+00E (+75m), this anomaly follows the axis of geophysical anomaly PP-2 and corresponds to the south side of a fractured fold axis containing quartz and sulfide showings.

- Grondin Zone Anomaly Five: Extending over 600m along PP-1 with a width of 25m, this anomaly is marked by pathfinder elements (Ag, As, Ba, Cu, Cd, Sb, Pb, Zn). It is associated with the Grondin mineralized zone, covering IP lines L30E to L38E.

High-Priority Drill and Bulk Sampling Targets

The integration of soil geochemistry and geophysical data has pinpointed areas of high-priority drill targets, particularly near anomalies on IP lines L30–L38 (Grondin Zone), L53E, L65E, L76E, and L109E. Specific zones within the Giroux and Grondin areas demonstrate strong geochemical and structural alignment, indicating significant potential for gold mineralization. These findings support the initiation of a focused drilling and bulk sampling program. The Company will proceed with filing the mandatory “Autorisation pour travaux à impact” (ATI) application with Quebec’s Ministry of Natural Resources to obtain drilling authorization.

Jean Bernard, BSc, Geo, a qualified independent person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in this release. QA/QC procedures for the reported soil sampling include the use of Certified Reference Materials from MSALABS (Test Certificate YVO 24011099). The ICP 130 analytical method was applied to 172 soil samples of 500 grams each.

Close of Non-Brokered Private Placement

Beauce Gold Fields Inc. is closing a non-brokered private placement of 250,000 flow-through units at four cents per unit for gross proceeds of $10,000.00 and 3,000,000 units at 3 cents per unit for gross proceeds of $90,000.00.

Each flow-through unit will comprise one flow-through common share and one common share purchase warrant of the company. Each warrant will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of 8 cents for a period of 24 months from the date of closing of the placement and each unit will comprise one common share and one common share purchase warrant of the company which will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of five cents for a period of 36 months from the date of closing of the placement. Securities issued under the financing are subject to a four-month hold period, in accordance with applicable Canadian securities laws. The placement is subject to standard regulatory approvals including the approval of the TSX Venture Exchange. The proceeds of the placement will be used: (i) to finance exploration and (ii) for general corporate purposes.

In connection with the placement, the company will pay as finder’s fees of $840 to StephenAvenue Securities Inc. of Toronto, Ont. The company will also issue 28,000 warrants to StephenAvenue Securities Inc. Those warrants will entitle the agent to purchase one common share of the capital stock of the company at a price of five cents for a period of 36 months from the date of closing of the placement. Shares issued on the warrants exercise are subject to a four month-hold-period from the date of closing of the placement.

Insiders of the company subscribed for 1,200,000 units in the placement composed of 250,000 flow-through units and 950,000 common share units. Patrick Levasseur, President & CEO of the company, subscribed for 125,000 flow-through units, for 250,000 share units and through Ice Age Gold, a company wholly owned by Mr Levasseur, for 700,000 share units. Following the completion of the private placement, Mr. Levasseur will beneficially own or exercise control or direction over, directly or indirectly, 10,331,622 shares representing 11.01% of the issued and outstanding common shares of the company. Ann Levasseur, a Director of the Company, subscribed for 125,000 flow-through units. As a result, Ann Levasseur will beneficially own or exercise control or direction over, directly or indirectly, 632,606 shares representing 0.67% of the issued and outstanding common shares of the company.

The participation of Patrick Levasseur and Ann Levasseur in the private placement constitutes a related party transaction within the meaning of Multilateral Instrument 61-101 — Protection of Minority Security Holders in Special Transactions, and TSX Venture Exchange Policy 5.9 — Protection of Minority Security Holders in Special Transactions. In connection with this related party transaction, the company is relying on the formal valuation and minority approval exemptions of subsections 5.5(a) and 5.7(1)(a) of MI 61-101, respectively, as the fair market value of the portion of the private placement subscribed by insiders does not exceed 25 per cent of the company’s market capitalization. The board of directors of the company has approved the private placement, including the participation of said Patrick Levasseur and Ann Levasseur.

No more than 10% of the proceeds of the placement can be used for Investor Relations Activities. None amount of the proceeds of the placement is for payments to Non-Arm’s length parties of the company nor for payments to persons conducting Investor Relations Activities.

Beauce Gold Fields is a gold exploration company focused on placer to hard rock exploration in the Beauce region of Southern Quebec.