Montreal, Quebec — Beauce Gold Fields (Champs D’Or en Beauce) (TSXV: ¨BGF¨), (“BGF”): (“BGF” or the “Company”), also known as “BGF” or the “Company” is pleased to announce chemistry results from a scan electron analysis of gold grains recovered from the bulk sampling of the Grondin antiform outcrop on the Company’s Beauce Gold property, located in the Beauce region of southern Quebec. The analysis indicates that the gold grains contain 15% silver and 85% gold.

Patrick Levasseur, President and CEO of Beauce Gold Fields, states, “With the recent significant rise in the price of silver, the discovery of silver in the gold grains and in drill cores marks a major milestone in our exploration efforts. The positive correlation of bedrock silver to silver in gold placers also provides valuable insights into the origins of our historic placer gold deposit.”

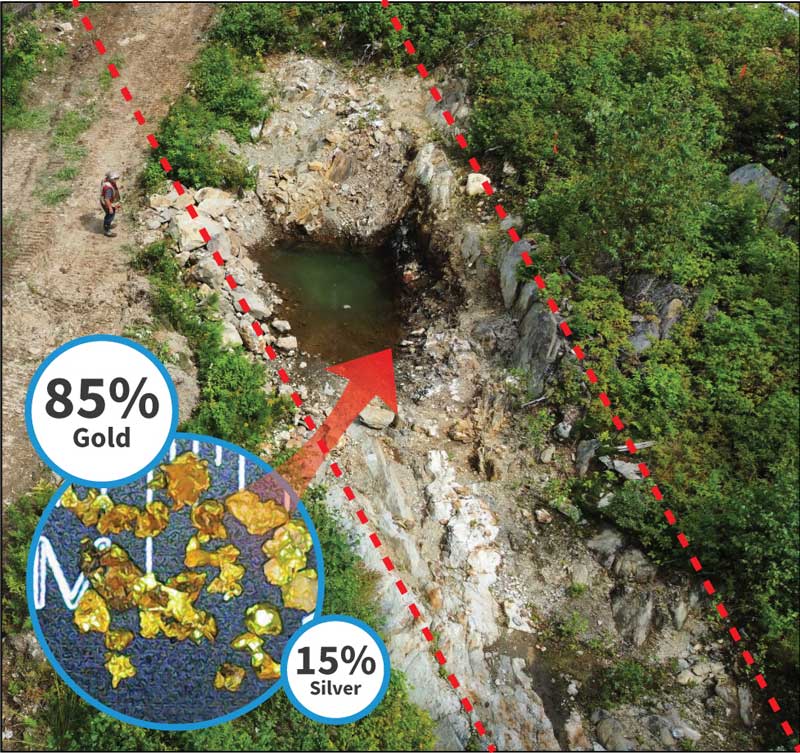

Image: Grondin Outcrop Gold Grains, Axis of Antiform,

GEOX Inc. was commissioned by the Company to characterize the chemistry of several gold grains recovered from a bulk sample of the Grondin antiform outcrop (BGF press release March 20, 2024).

The gold grains were mounted on a polished thin section by VanPétro / Vancouver Petrographics Ltd. The grains were observed with a petrographic microscope and analyzed with a scanning electron microscope (SEM) and Energy Dispersive X-ray (EDS) at IOS Services Géoscientifiques Inc. Each EDS analysis contains 2 million effective counts, a process time aimed at the best spatial resolution, and a dead time of less than 55%.

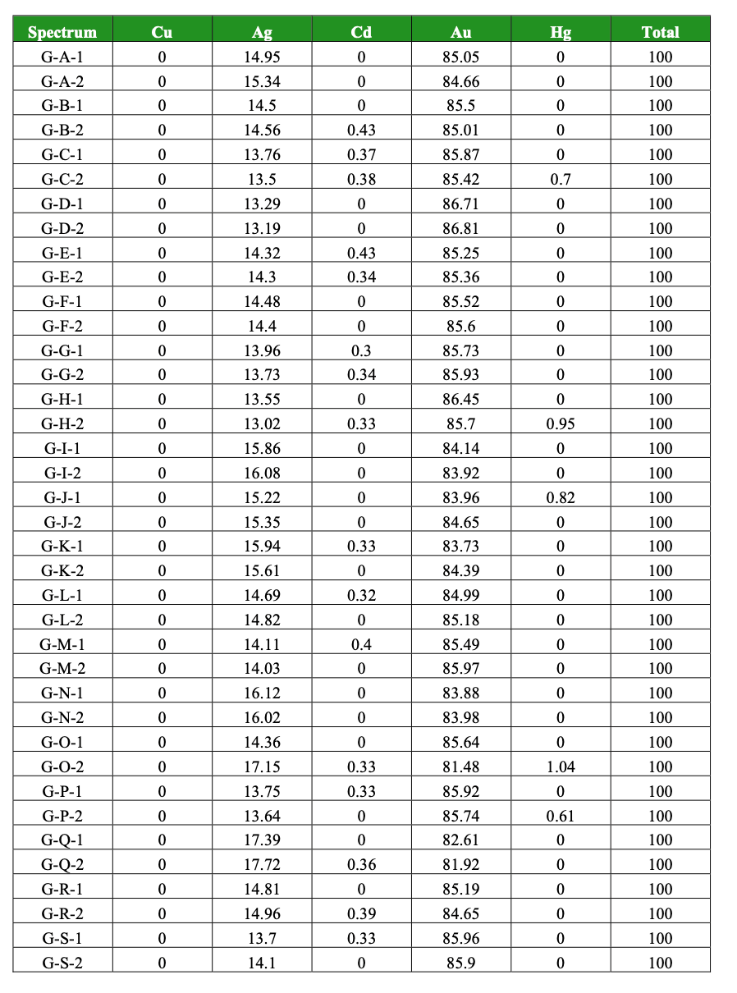

The SEM-EDS analyses indicate that the gold grains averaged 85.05% gold (Au), 14.74% silver (Ag) with a fineness of the gold grains (calculated as 1000 * Au / (Au + Ag)) ranging between 820 and 870. The silver content is relatively homogeneous. Half the samples contained trace elements of Cd and Hg. The grains contained no copper and no electrum. The 15% silver content is typical of orogenic environments however the absence of detectable copper points to a source with a particular chemistry.

Table 1. Analytical results (by weight%)

The 14.75% silver content of the Grondin grains from the bedrock outcrop is comparable to the silver recovered from past placer gold mining operations 3 km to the southeast. Historical receipts from the Royal Canadian Mint for the 1960s Beauce Placer Mining dredging operation indicated an average silver to gold content of 13%. An 1863 Geological Survey of Canada report by T. Sterry Hunt recorded a silver to gold content of 12.54%.

Mineralized zones from the Grondin diamond drill cores (hole GR 23-01, BGF Press Release January 18, 2024) reported anomalous silver levels averaging 0.79 ppm. By consolidating the silver content with the gold zone intersects, which averaged 3.33 g/t of gold, we achieve a silver to gold ratio of 23.68%. The lower silver content in the Grondin outcrop gold grains and in the historical placer production, compared to the silver disseminated in Grondin drill cores, suggests loss attributed in part to weathering and dissolution of the metal during transport.

The similar in situ silver content in Grondin gold grains to the placer gold suggests detrital transport of gold particles, adding support to the idea that mineralized antiform structures are the genesis of the historic placer gold deposits.

According to the GEOX study, compared to grains from different mineralized zones, the gold in the Grondin sample has an silver content similar to that of gold from alkaline porphyry-type mineralizations. This sample likely comes from an orogenic gold-type mineralization.

Epigenetic gold deposits formed in an orogenic context offer a wide variety of lithological hosts. Orogenic-type gold deposits account for more than 30% of the world’s gold production. These deposits show a significant spatial association with dilation structures. These structures, which serve for the precipitation of economic substances from hydrothermal fluids, are varied and include anticline fold hinges, fractures associated with competency contrasts between units, and fault intersections.

Jean Bernard, B,Sc. Geo., is a qualified person, as defined by NI 43-101, who has reviewed and approved the technical information presented in this release.

Close of Non-Brokered Private Placement

Beauce Gold Fields Inc. is closing a non-brokered private placement of 2,475,000 flow-through units at four cents per unit for gross proceeds of $99,000.00 and 5,335,714 units at 3.5 cents per unit for gross proceeds of $186,750.00.

Each flow-through unit will comprise one flow-through common share and one common share purchase warrant of the company. Each warrant will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of 8 cents for a period of 24 months from the date of closing of the placement and each unit will comprise one common share and one common share purchase warrant of the company which will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of five cents for a period of 36 months from the date of closing of the placement. Securities issued under the financing are subject to a four-month hold period, in accordance with applicable Canadian securities laws. The placement is subject to standard regulatory approvals including the approval of the TSX Venture Exchange. The proceeds of the placement will be used: (i) to finance exploration and (ii) for general corporate purposes.

In connection with the placement, the company will pay as finder’s fees $2,800 to StephenAvenue Securities Inc. of Toronto, Ont., $2,240 to Jean-David Moore of Quebec and $5,600 to Glores Securities Inc of Toronto, Ont. The company will also issue 80,000 warrants to StephenAvenue Securities, 32,000 warrants to Jean-David Moore and 160,000 to Glores Securities. Those warrants will entitle the agent to purchase one common share of the capital stock of the company at a price of five cents for a period of 36 months from the date of closing of the placement. Also, the company will issue to Jean-David Moore 28,000 warrants entitling the agent to purchase one common share of the capital stock of the company at a price of eight cents for a period of 24 months from the date of closing of the placement.

Patrick Levasseur, President & CEO of the company, through Ice Age Gold, a company wholly owned by Mr Levasseur, subscribed for one million units. Following the completion of the private placement, Mr. Levasseur will beneficially own or exercise control or direction over, directly or indirectly, 8,181,622 shares representing 9.03 per cent of the issued and outstanding common shares of the company.

The participation of Mr. Levasseur in the private placement constitutes a related party transaction within the meaning of Multilateral Instrument 61-101 — Protection of Minority Security Holders in Special Transactions, and TSX Venture Exchange Policy 5.9 — Protection of Minority Security Holders in Special Transactions. In connection with this related party transaction, the company is relying on the formal valuation and minority approval exemptions of subsections 5.5(a) and 5.7(1)(a) of MI 61-101, respectively, as the fair market value of the portion of the private placement subscribed by insiders does not exceed 25 per cent of the company’s market capitalization.

Beauce Gold Fields is a gold exploration company focused on placer to hard rock exploration in the Beauce region of Southern Quebec.