Montreal, Quebec — Beauce Gold Fields (Champs D’Or en Beauce) (TSXV: ¨BGF¨), (“BGF”): (“BGF” or the “Company”), also known as “BGF” or the “Company” announces that it has acquired, through map staking, 21 mineral claims to cover the multikilometer-long antiform mineralized structure.

This acquisition expands the Company’s Beauce Gold property to the northeast, which now totals 241 claims located in Beauceville and Saint-Simon-les-Mines, Quebec.

Patrick Levasseur, President and CEO of Beauce Gold Fields, states, “We will be expanding our exploration efforts over antiform mineralized structures that have been identified as the source of historic placer gold deposits and show great promise for further lode gold discoveries.”

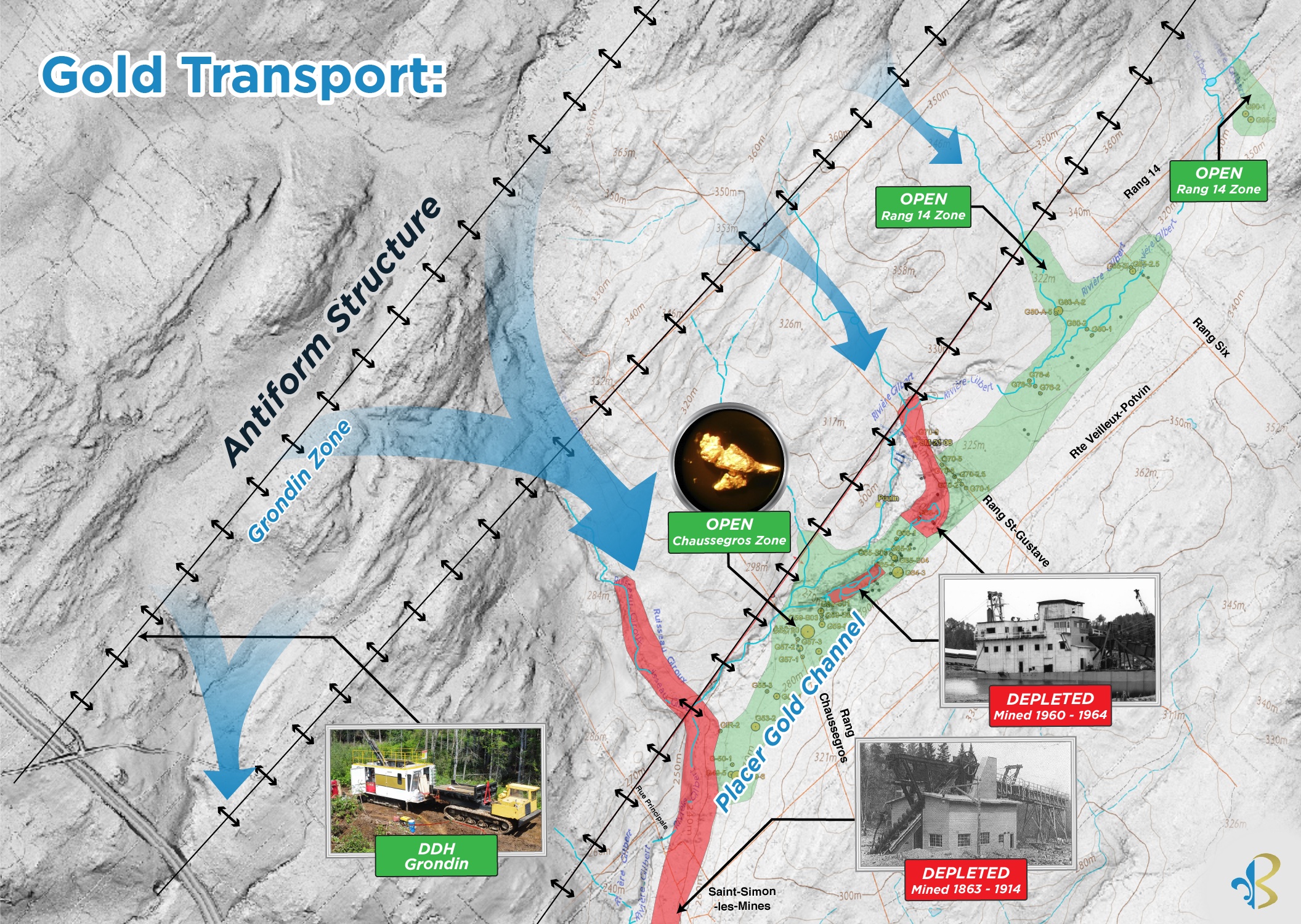

Image: Gold Transportation Flow from Anti Form Structures to Placer Channel

About the Grondin Gold Zone and Antiform Structures

The Grondin Zone is located in the northwest corner of the Beauce Gold property located in Beauceville and in Saint-Simon-les-Mines, Quebec. The 2023 exploration initiatives at the Grondin Zone, comprising both bulk processing and drilling, (BGF press releases, November 1 2023 and January 18 2024) revealed that the zone extends over 40 meters deep vertically and remains open at depth, with a mineralized structure stretching more than 300 meters in length. This zone is intrinsically linked to an antiform fold axis that spans several kilometers, suggesting that other gold showings may be present along the antiform fold and elsewhere on the Beauce Gold property indicating a significant potential for lode gold discoveries from this gold structure.

A positive correlation applies to silver and the pathfinder elements that were identified in the Grondin mineralized antiform structure with those found in the basal till and the saprolite of the placer gold channel of the Gilbert River valley. (press release January 18, 2024) This correlation is corroborating evidence that these antiform systems could have contributed to the development of the extensive auriferous placers in Beauce.

It also supports the hypothesis that placer gold within the Beauce Gold paleochannel, including the renowned large nuggets from the 19th century, formed in stressed quartz pockets within layered domed axis of antiforms, exemplified by Saddle Reef formations. Notable global Saddle Reef formations include the Bendigo gold fields in Australia (over 60 million ounces) and the high-grade Dufferin deposit in Nova Scotia.

Non-brokered private placement

The Company will proceed with a non-brokered private placement of 2,500,000 Flow-Through units at $0.04 per unit for gross proceeds of $100,000 and 6,000,000 Hard Dollar units at $0.035 per unit for gross proceeds of $210,000.

Each Flow-through unit will be comprised of one (1) Flow-through common share and of one (1) common share purchase warrant of the company. Each warrant will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of $0.08 for a period of 24 months from the date of closing of the placement and each Hard Dollar unit will be comprised of one common share and one common share purchase warrant of the company which will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of $0.05 for a period of 36 months from the date of closing of the placement.

The offering is conditional upon the receipt of all necessary regulatory approvals, including the approval of the exchange. The proceeds of the offering will specifically be used: (i) to finance exploration and (ii) for general corporate purposes.

The offering will be offered to accredited investors in accordance with applicable securities laws. In connection with the offering, the company may pay finders’ fees, as permitted by the policies of the exchange. Each share issued pursuant to the placement will have a mandatory four-month-and-one-day hold period from the date of closing of the placement. The company anticipates that insiders will subscribe for units and their participation could exceed 25 per cent of the offering.

No more than 10% of the proceeds of the placement can be used for Investor Relations Activities. None amount of the proceeds of the placement is for payments to Non-Arm’s length parties of the company nor for payments to persons conducting Investor Relations Activities.

The Company will not be proceeding with the previously announced Existing Shareholder placement as stated in the April 29, 2024 press release.

Beauce Gold Fields is a gold exploration company focused on placer to hard rock exploration in the Beauce region of Southern Quebec.