Montreal, Quebec — Beauce Gold Fields (Champs D’Or en Beauce) (TSXV: ¨BGF¨), (“BGF”): (“BGF” or the “Company”): With the Ditton Placer Gold Channel drill campaign on the Company’s Megantic project nearing completion, the Company is pleased to announce it will resume exploration on Beauce Gold property located in St-Simon les Mine, Quebec. Focus will be the exploration of an Axis of an Antiform outcrop indicative of a Saddle Reef formation.

Patrick Levasseur, President and CEO of Beauce Gold Fields said, “We are excited to pick-up where we left off our exploration work on the Beauce Gold property.” Mr. Levasseur further stated, “Exploring and sampling the Axis of an Antiform outcrop of the Grondin showing will test the Saddle Reef Formation as the leading geological model for possible lode gold discoveries as the source of the historical placer gold deposit.”

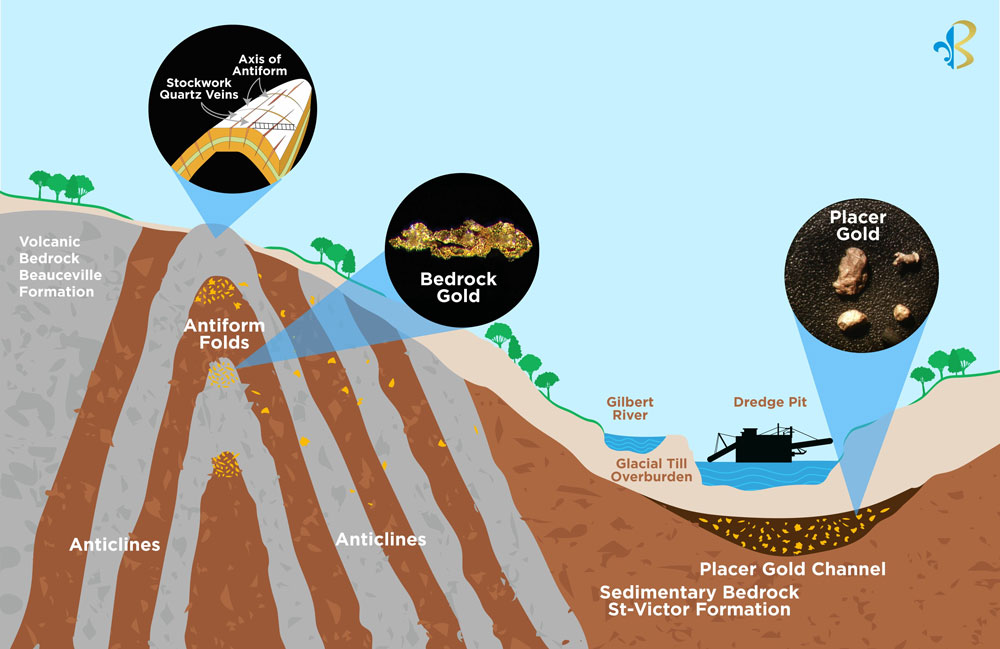

Geological Model of a Saddle Reef Formation

Over the next two months, Company will continue to delineate, expose and sample significant mineralized Crack and Seal type quartz veins stockwork outcroppings along the Axis of the Antiforms. Focus will be exploring an important exposed domed Axis of Antiform ridge outcrop known as the Grondin showing on the recently acquired 14 claims that enlarged the Beauce Gold property to the northwest (BGF press release June 10, 2022). The Axis outcrop of the Grondin showing extends 500 meters NE along strike onto the Company’s claims. It is approximately 3km upstream/uphill of the 19th-century placer gold mines at Giroux Creek and Gilbert river confluence and parallels to the historical placer gold deposit of St-Simon-les-Mine. Two of the highest gold grades reported from the outcrop were in samples 81755 @ 2.11 grams/ton), and sample 81763 @10.9 grams/ton (GM 70761 Réjean Hébert, géo. June 2018)

The geological model of a Saddle Reef formation is supported by IP surveys, by observed eroded anticline vertical limbs of layered sedimentary and volcanic bedrock in the 2019-2020 trenches and by the discovery of exposed domed Axis of Antiform ridges along the Giroux creek. The Axis trends NE & SW for 4 km to the North of the Gilbert River and north of the historical placer gold channel (BGF press releases 2021-12-21, 2021-03-19). Eroded segments of the Saddle Reef formation is the leading hypothesis as to the source of the historical placer gold deposit.

It is theorized that the placer gold, such as the famous large nuggets mined in the 19th century, were formed in stressed quartz pockets of layered domed Axis of Antiforms as demonstrated in Saddle Reef formations. Saddle Reef examples include the vast Bendigo and Ballarat gold fields of Australia (over 60 million ounces), and the high-grade Dufferin deposit in Nova Scotia.

Jean Bernard, B,Sc. Geo., is a qualified person as defined by NI 43-101 who has reviewed and approved the technical information presented in this release.

Non-brokered private placement

The Company will proceed with a non-brokered private placement of 4,500,000 Flow-Through units at $0.05 per unit for gross proceeds of $225,000 and 3,000,000 units at $0.035 per unit for gross proceeds of $105,000.

Each Flow-through unit will be comprised of one (1) Flow-through common share and of one half (1/2) common share purchase warrant of the company. Each full warrant will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of $0.11 for a period of 24 months from the date of closing of the placement and each unit will comprise of one common share and one common share purchase warrant of the company which will entitle the holder thereof to purchase one common share of the capital stock of the company at a price of $0.10 for a period of 36 months from the date of closing of the placement.

The offering is conditional upon the receipt of all necessary regulatory approvals, including the approval of the exchange. The proceeds of the offering will be used: (i) to finance exploration and (ii) for general corporate purposes.

The offering will be offered to accredited investors in accordance with applicable securities laws. In connection with the offering, the company may pay finders’ fees, as permitted by the policies of the exchange. Each share issued pursuant to the placement will have a mandatory four-month-and-one-day hold period from the date of closing of the placement. The company anticipates that insiders will subscribe for units and their participation could exceed 25 per cent of the offering.

Beauce Gold Fields is a gold exploration company focused on placer to hard rock exploration in the Beauce region of Southern Quebec.